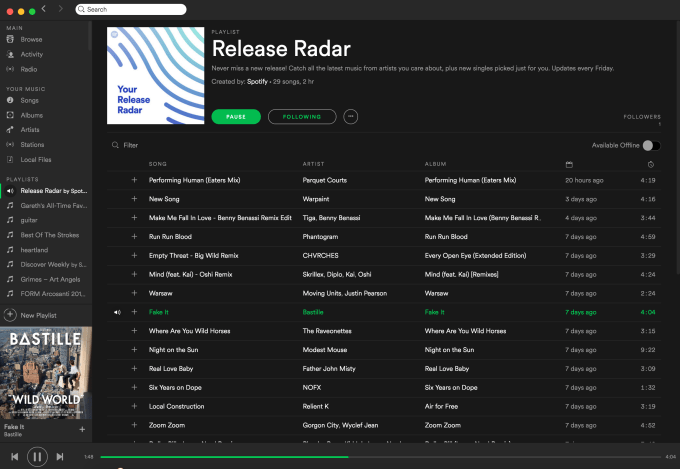

Spotify is doubling down on its strategy to beat Apple Music with big data-driven personalized playlists like Discover Weekly — a huge hit that saw 40 million users in its first year. Today it launches Release Radar, a 2-hour algorithmically personalized playlist updated each Friday that features newly released songs from artists each user already listens to.

Release Radar will appear at the top of users’ collection of playlists instead of being buried in the graphically organized Browse tab like Spotify’s existing home for finding new releases. The playlist format is more familiar, and users can easily turn it on and continue with their day instead of having to pick something different to play when each songs end.

“The same way that Discover Weekly was able to set Spotify apart from other music services, we’re trying to show that Spotify understands users better than anyone else,” the product’s lead engineer Edward Newett tells me. “I think over time I think over time we’ll see other music services building Discover Weekly clones, but I think Spotify still has a leg up. We’re the first to be solving this. We’re the biggest in terms of streaming data to bring the personalization necessary to make this feature work.”

I demoed the Release Radar playlist this week and was astounded by the accuracy of its recommendations. While Discover Weekly purposefully showed you artists you hadn’t heard of, Spotify’s algorithm quality is much easier to judge based on Release Radar. Its ability to surface songs by artists I used to play a lot but not recently make it a great complement to the Spotify search box, which can be daunting.

Spotify’s 2014 acquisition of music personalization data provider The Echo Nest is looking like a smarter and smarter move as the on-demand streaming wars get into full swing. Discover Weekly received 5 billion song plays in the first 10 months since launching in July 2015, with at least half the users saving a song each week.

And it’s working. More than half of Discover Weekly’s users save at least one song, listen to at least 10 tracks each week and come back the next week. The 25-to-34 age group is using it the most, which Newett says is because these are “the years after college” when your social network has changed and you’re craving exposure to new tunes like you used to get because “it’s not as easy to discover music.”

Here are the major players, and their strengths and weaknesses:

Here are the major players, and their strengths and weaknesses:- Spotify – the one with personalization – A big head start gives it the lead with 100 million listeners, including 30 million paid subscribers, the ad-supported tier helps it lure in users, The Echo Nest and historical listening data power deep personalization of suggestions in playlists like Discovery Weekly and Release radar, strong features as it’s a long-running music product-focused startup, but as a venture-backed company it can’t outspend Apple on marketing, and has lacked headline-worthy exclusives

- Apple Music – the one with the money — Massive install base from pre-loads on iPhones, integration with your existing iTunes library and some exclusives thanks to its deep pocket. But it launched late, though it’s hit 15 million paid subscribers as it tries to catch up, has been criticized as confusing, and lacks a free ad-supported tier.

- Tidal – the one with the exclusives — High-quality exclusives or early access to releases from Beyonce and Kanye West, but a late start, limited features, and no ad-supported tier.

- YouTube – the one with the users – Its free, ad-supported default has helped YouTube grow to over 1 billion users. Music videos consistently draw big audiences — especially teens. It recently launched its ad-free YouTube Red subscriptions with exclusive video content to earn it and creators more money, but its interface isn’t built for music listening and the frequent pre-roll ads are more interruptive than the audio ads heard on Spotify.

- SoundCloud – the one with the DJs – Hosts the legal gray area of music, including unofficial remixes and multi-hour DJ mixsets, feed format promotes discovery, and the ability to self-publish makes it a favorite amongst indie acts. But SoundCloud lacks a lot of popular music, can feel disorganized, some artists and DJs are angry about having their music removed for copyright infringing samples, and its SoundCloud Go subscription service doesn’t seem to be growing, as the company has suffered enormous financial losses and has had to take on dirty fundraises.

- Pandora – the one with just radio – Synonymous with radio on the internet, low ad load makes its free tier great for people who don’t want to DJ, and the music genome project and listening data help it make personalized song recommendations. But users crave to listen to artists on-demand after they discover them on Pandora. It’s been slow to relaunch an on-demand service from the corpse of Rdio it acquired, and other services are making personalized radio just a feature among their offerings — yet it just rejected a buyout offer from Sirius XM radio’s parent company despite trends going against Pandora.

While YouTube owns an important part of the market, the dedicated music streaming service battle is shaking out to be a war between Spotify and Apple Music. To defeat the hardware giant’s ability to outspend it on marketing and exclusives, Spotify will have to rely on its free tier to seduce non-streamers, and then use personalized product features like Release Radar to lock them in and convince them to buy a subscription.

0 Response to "Spotify follows Discover Weekly with personalized new releases playlist"

Post a Comment