Aug 03, 2016

18:57 (IST)

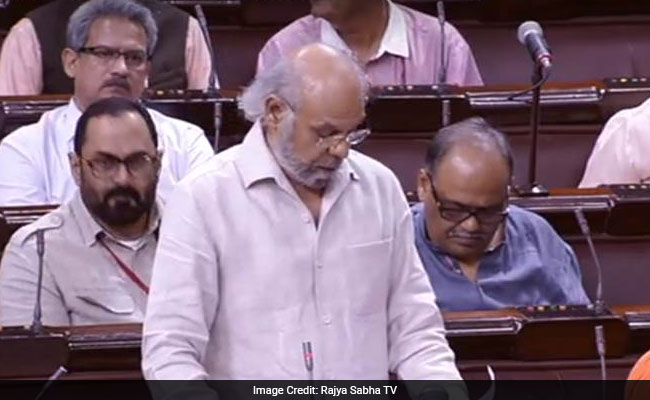

A cap on tax rate will ensure that the indirect taxes are not too high: D Raja, CPI, Tamil Nadu

Aug 03, 2016

18:55 (IST)

Shiromani Akali Dal's Naresh Gujral urges all parties in Rajya Sabha to support the GST bill which he said would help in creating more jobs and congratulates Arun Jaitley on a commendable job.

Aug 03, 2016

18:46 (IST)

Shiv Sena's Anil Desai highlights the loss of revenue to local bodies such as Mumbai Municipal Corporation which he says earns over 7,000 crore yearly, and asks the Finance Minister to clarify on compensation directly to such bodies.

Aug 03, 2016

18:37 (IST)

I have a problem with the government seeking for the support now when they opposed the bill when it was introduced by the Congress over 4 years ago. The government says the GST bill will raise India's GDP by 1-2 per cent. Then why didn't the BJP support the bill as opposition? Narendra Budania, Congress, Rajasthan

Aug 03, 2016

18:30 (IST)

Tamil Nadu has a huge borrowing of 2 lakh crores. It should not be further burdened. The compensation for first 5 years of revenue loss of states should be 100 per cent and it should be clearly mentioned: TKS Elangovan, DMK

Aug 03, 2016

18:06 (IST)

Ek Vidhan, Ek Karadhan (One Legislation, One Taxation): BJP's Mahesh Poddar

- The GST bill simplify and synchronise indirect tax regime. From 5-7 tax laws to 2 will simplify lives of people

- It will reduce the multiplicity of taxes and reduce the hidden cost in commerce

- This is the first time we will be talking as one nation on taxes

Aug 03, 2016

17:55 (IST)

Sikkim will lose revenue on the account of not being able to levy 1 per cent extra surcharge as per the bill. Hope the Finance Minister speaks on the issue: Hishey Lachungpa, SDF, Sikkim

Aug 03, 2016

17:45 (IST)

We want a constitutional guarantee and clarity on the mode of payment of Centre's compensation for states' revenue losses for first 5 years: Garikapati Mohan Rao, TDP, Telangana

Aug 03, 2016

17:41 (IST)

We have no reservations when it comes to the bill, it's progressive and we're glad it's finally getting passed, but the demands of Odisha are being suppressed: Biju Janata Dal's Dilip Kumar Tirkey

Aug 03, 2016

17:35 (IST)

We support the bill but there are doubts. When the Finance Minister clarifies, he must also speak on the timeline of implementing it: Surendra Singh Nagar, Samajwadi Party, UP

Aug 03, 2016

17:23 (IST)

GST will bring uniformity. A global investor will benefit if the same law is practiced in all states. This will make India one large market and an investment destination: BJP's Ajay Sancheti

Aug 03, 2016

17:14 (IST)

Congress's Vivek Tankha reiterates party's demand to cap the GST rate, says 18 per cent already too high

- If the indirect tax rate is higher than 18 per cent, it will affect inflation and the lives of people.

- Revenue sharing model between the states and Centre must be spelled out.

- Like Mr Chidambaram said, we support the idea and the bill subjective to clarification by the Finance Minister

Aug 03, 2016

17:06 (IST)

GST is India's biggest indirect taxes reform, which affects every business big and small: Rajeev Chandrasekhar, Independent MP from Karnataka

Aug 03, 2016

16:56 (IST)

I urge to bring it (GST) as finance bill and not as money bill, says Praful Patel

- Earlier the bill only spoke of goods, now services are crucial which will change and improve further.

- I urge all sections of the house to support the bill and urge the government to take us along as partners and discuss in this house before you take the final steps.

Aug 03, 2016

16:54 (IST)

For far too long we have had different tax structures in our country. It led to loss of revenue to the exchequer. The GST is a step in major reform that must meet its logical conclusion: Praful Patel

Aug 03, 2016

16:52 (IST)

NCP's Praful Patel: We must address the issue of the poorer states. It is in this spirit that progressive states like Maharashtra have come in support of the bill.

Aug 03, 2016

16:48 (IST)

Telugu Desam Party's CM Ramesh: We support this (GST) bill.

Aug 03, 2016

16:39 (IST)

BSP backs Congress' demand to bring the GST Bill as a Finance Bill before implementation and not a Money Bill so it is discussed in both houses of parliament

- We are supporting the bill to back 90 per cent of the people of this nation which is hoping the bill will help the economy.

Aug 03, 2016

16:36 (IST)

Goods and Services Tax has been given massive powers. It takes away from power of the states to amend laws which affects its people: Satish Misra

Aug 03, 2016

16:32 (IST)

0 Response to "Live: GST Bill Debate In Rajya Sabha, Congress Urges Cap On Tax Rate"

Post a Comment